Radio cassette? What’s that?

Do you know what a ‘radio cassette player’ is?

I ask because it really depends on what age you are. There is a large chunk of young Kenyans (and, I hope, of the readers of this column) who have never experienced such a thing.

Even if you do know what it is, when was the last time you had the experience of using one? You know, of inserting a well-worn cassette tape into the slot in the player in your house or car, and hearing some hissy and scratchy music ensuing as the tape rubbed mechanically against a magnetic head?

Anyone?

I am raising this issue because the other day I was trying to renew my car insurance, and noticed something that has always been highlighted in the policy as one of the items in the vehicle that will be protected against damage or theft. You got it – the radio cassette player.

That item, worded like that, has been in insurance policies ever since I drove my first car decades ago. It’s still there. Yet the last time I bought a car with a radio cassette player installed was at least twenty years ago.

It seems our insurers missed not only the arrival of the in-car compact disc player, but also its demise; those players have come and gone, without insurers noticing. Of the quotations I considered, only one company had modernised its wording, referring to the ‘vehicle entertainment system.’

Insurance executives, you leave us wondering: how old are the cars you drive? How do you listen to music these days, and where is your collection housed? Have you come across music streaming yet?

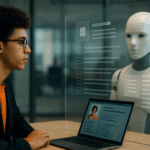

I’m raising this only partly in jest. Insurance is facing immense disruption in the coming months and years. Not only is app-centred insurance rapidly going to become a mainstream channel, but artificial intelligence will change the game by assessing risk far more accurately than humans do. Surveillance devices will reveal the truth about incidents and claims more accurately than investigators can. On-skin devices and under-skin implants will revolutionise health insurance. Car ownership and accident incidence will enter a new era when electric, autonomous vehicles come into play.

It’s really not a time to be stuck in the past. And yet you are.

Language matters. If you don’t even notice how archaic your words are, are you really paying attention to the changes that will convulse your business model? If you are still run by the old and the tired, will you have the energy and appetite for revolutionary change from within?

This is of course not just about insurers. Many other sectors face these convulsions, caused by the uniquely African combination of a very young populace that’s now always connected by devices and clouds. Media, entertainment, retail, banking, healthcare, education will perhaps see the most tumult. Are they any better prepared? Or are they also relying on the minds, models and modes of the past?

There is a past we always need to protect. Things such as our heartfelt business values, our strategic intent, our distinctive way of adding value to the lives of our customers should be ring-fenced and guarded. Those are timeless. We should always stand for certain aims and norms.

Everything else changes, though. As consumer habits evolve, our revenue mix will bubble and change. Business channels, organisational structures, systems and processes must keep pace. A good leader keeps a very keen eye on the likely landscapes of the future. Such a leader periodically looks at the policies, procedures and processes of his or her organization and asks: which part of this is hopelessly passé? What was linked to long-gone technology? What mattered when the world was different, but doesn’t now?

A very good strategic practice to run at the beginning of every year is to ask staff what part of their work is old-fangled, antiquated and irrelevant these days. Then look through the best suggestions and create a ‘let’s-burn’ list. Gather everyone around, light a symbolic fire, and say goodbye to the words, practices and norms of bygone eras. Sometimes you need to burn the old grass to allow for its renewal.

If you don’t do this, you always add and never subtract, and end up with a freakish hydra with many heads. You will hope to win in the future while staying rooted in the past. You will be weird and unwieldy. So whatever business you’re in, walk around and pay attention to what’s changing.

Will traditional insurers change the language on their policies, or even the policies themselves, at your next renewal date? I am not hopeful.

(Sunday Nation, 9 February 2020)

Buy Sunny Bindra's new book

The X in CX

here »

Popular Posts

- Make this your year of being boringJanuary 4, 2026

- Snakes and Ladders, AKA your lifeJanuary 25, 2026

- Can we please stop with the corporate jargon?January 11, 2026

- The man who passed by one markJanuary 18, 2026

- Pretty isn’t the productFebruary 1, 2026